FreetaxUSA Limit: A Comprehensive Guide To Understanding Your Tax Filing Boundaries

Hey there, tax enthusiast! Ever wondered what the deal is with FreetaxUSA and its limits? If you're like most people, tax season can feel like navigating a maze—but don’t worry, we’re here to break it down for you. Whether you’re a seasoned pro or a first-timer, understanding FreetaxUSA’s boundaries is key to making the most out of your tax filing experience. So, let’s dive right in and explore what FreetaxUSA limit means for you.

Taxes can be overwhelming, especially when you’re dealing with platforms like FreetaxUSA. But here’s the good news: once you understand the ins and outs, it becomes way easier. In this guide, we’ll walk you through everything you need to know about FreetaxUSA limit—what it is, why it matters, and how you can stay within the boundaries while still getting the most out of your tax return. Think of it as your personal cheat sheet for tax season!

Now, before we get into the nitty-gritty, let’s talk about why FreetaxUSA has become such a go-to for so many people. It’s not just about filing taxes; it’s about doing it right, fast, and hassle-free. But, like any platform, there are limits—and understanding those limits can save you a ton of headaches. Let’s take a closer look!

What Exactly Is FreetaxUSA Limit?

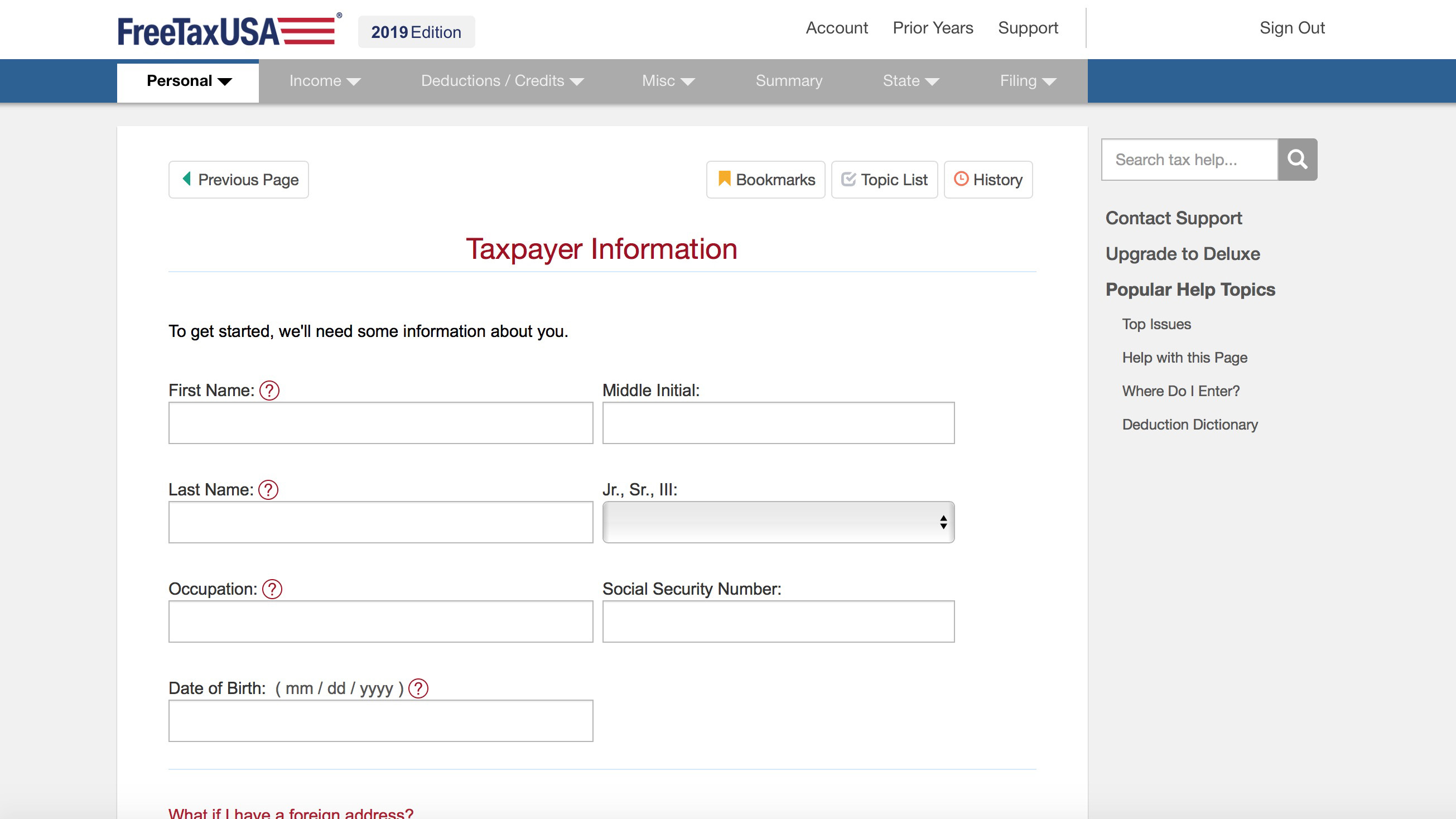

Alright, so first things first—what exactly do we mean by FreetaxUSA limit? Simply put, FreetaxUSA limit refers to the boundaries set by the platform to ensure a smooth and efficient tax filing process. These limits can vary depending on factors like the type of tax forms you’re filing, your income level, and even the specific features you’re using. Think of it like a roadmap that keeps you on track while you navigate the world of taxes.

For example, FreetaxUSA might have certain limits on the number of forms you can file for free or the complexity of the tax situations they handle. Understanding these limits upfront can help you plan better and avoid any surprises down the road.

Why Should You Care About FreetaxUSA Limits?

Here’s the thing—tax filing isn’t just about submitting your forms on time. It’s about doing it correctly and ensuring you’re maximizing your return. FreetaxUSA limits are in place to help streamline the process, but they also serve as a reminder of what the platform can and can’t handle. Ignoring these limits could lead to errors, delays, or even missed deductions.

- Philippine Leroybeaulieu Husband A Deep Dive Into The Life Of The Talented Actress

- Understanding Perdita Weeks Disability A Deep Dive Into Her Journey

For instance, if you exceed the income threshold for free filing, you might need to upgrade to a premium plan. Or, if you’re dealing with complex tax situations like multiple properties or international income, you might find that FreetaxUSA’s standard offerings don’t quite cut it. Knowing your limits ahead of time can save you both time and money.

Common FreetaxUSA Limit Scenarios

Income Thresholds

One of the most common FreetaxUSA limits revolves around income thresholds. The platform offers free filing for individuals with an adjusted gross income (AGI) below a certain amount. As of 2023, this threshold is typically around $75,000, but it can vary depending on updates and changes in tax laws. If your income exceeds this limit, you might need to explore other options or upgrade to a premium plan.

Form Limitations

Another key area where FreetaxUSA sets limits is on the types of forms you can file. While the platform covers the basics like Form 1040, Schedule A, and Schedule C, more complex forms might require additional tools or services. For example, if you’re dealing with Form 1120 for corporate taxes or Form 1040-NR for non-resident aliens, you might find that FreetaxUSA’s standard offerings fall short.

State Tax Filing

State tax filing is another area where FreetaxUSA limits come into play. While the platform offers free federal filing for eligible users, state tax filing often requires a separate subscription or fee. This is something to keep in mind if you’re planning to file taxes in multiple states or need additional support for state-specific forms.

How to Stay Within FreetaxUSA Limits

Now that we’ve covered the basics, let’s talk about how you can stay within FreetaxUSA limits without compromising on quality. Here are a few tips to help you navigate the process:

- Know Your Income Level: Before you start filing, make sure you’re aware of your AGI and whether you qualify for free filing. This can save you a lot of headaches down the line.

- Review Your Tax Situation: Take a closer look at your tax forms and determine if you’re dealing with any complex situations that might require additional tools or services.

- Plan for State Taxes: If you’re filing state taxes, be prepared for potential fees or the need for a premium plan. It’s always better to plan ahead than to be caught off guard.

Alternatives to FreetaxUSA

Other Tax Filing Platforms

While FreetaxUSA is a great option for many people, it’s not the only game in town. If you find that you’re consistently bumping up against FreetaxUSA limits, it might be worth exploring other platforms. Some popular alternatives include TurboTax, H&R Block, and TaxSlayer. Each of these platforms offers its own set of features and limitations, so it’s important to do your research and choose the one that best fits your needs.

Consulting a Tax Professional

For those dealing with particularly complex tax situations, consulting a tax professional might be the best option. While it can be more expensive upfront, working with a CPA or tax advisor can save you time, money, and a lot of stress in the long run. Plus, they can help you navigate any FreetaxUSA limits you might encounter and ensure you’re getting the most out of your tax return.

Understanding Tax Laws and Regulations

Staying Updated on Changes

Tax laws and regulations are constantly evolving, and staying informed is key to making the most out of your FreetaxUSA experience. From changes in income thresholds to updates in form requirements, being aware of these changes can help you stay within FreetaxUSA limits and avoid any potential issues.

Common Tax Deductions

Another important aspect of understanding FreetaxUSA limits is knowing about common tax deductions. From standard deductions to itemized deductions, there are plenty of ways to reduce your taxable income and maximize your return. Make sure you’re taking advantage of all the deductions you qualify for, and don’t be afraid to reach out to a tax professional if you’re unsure about anything.

Real-Life Examples of FreetaxUSA Limits

Let’s take a look at a few real-life examples to see how FreetaxUSA limits play out in practice:

- Example 1: Sarah has an AGI of $70,000 and qualifies for free federal filing through FreetaxUSA. However, she also needs to file state taxes in two different states, which requires a premium plan.

- Example 2: John runs a small business and needs to file Schedule C along with his Form 1040. While FreetaxUSA can handle this, he finds that he needs additional support for some of the more complex aspects of his tax situation.

Expert Tips for Maximizing Your FreetaxUSA Experience

Here are a few expert tips to help you get the most out of FreetaxUSA while staying within the limits:

- Start Early: The earlier you start your tax filing process, the more time you’ll have to address any issues or questions that come up.

- Double-Check Your Work: Always double-check your forms before submitting them to avoid any errors or omissions.

- Stay Organized: Keep all your tax documents in one place to make the filing process as smooth as possible.

Conclusion: Taking Control of Your Tax Filing

And there you have it—a comprehensive guide to understanding FreetaxUSA limits and how they impact your tax filing experience. Whether you’re dealing with income thresholds, form limitations, or state tax filing, knowing your limits can help you stay on track and avoid any potential issues.

So, what’s the next step? Take a closer look at your tax situation, review your options, and make a plan that works for you. And don’t forget to share this guide with your friends and family—because who doesn’t love a good tax tip? Happy filing!

Table of Contents:

- What Exactly Is FreetaxUSA Limit?

- Why Should You Care About FreetaxUSA Limits?

- Common FreetaxUSA Limit Scenarios

- Income Thresholds

- Form Limitations

- State Tax Filing

- How to Stay Within FreetaxUSA Limits

- Alternatives to FreetaxUSA

- Other Tax Filing Platforms

- Consulting a Tax Professional

- Understanding Tax Laws and Regulations

- Staying Updated on Changes

- Common Tax Deductions

- Real-Life Examples of FreetaxUSA Limits

- Expert Tips for Maximizing Your FreetaxUSA Experience

Article Recommendations

- Dan Greiner The Journey Of A Business Visionary

- Kyla Wayans A Deep Dive Into The Life Of A Rising Star

Detail Author:

- Name : Miss Ernestine Blanda

- Username : hintz.jordane

- Email : lmarks@stehr.biz

- Birthdate : 1970-05-22

- Address : 67137 Rosenbaum Trail North Susan, RI 74077-5944

- Phone : +1-551-716-3675

- Company : Dicki-Zemlak

- Job : Photographic Developer

- Bio : Dolores aliquid ut nostrum commodi natus. Expedita facere eligendi facere ut incidunt fugiat fugiat. Quia voluptas pariatur nisi et non ad.

Socials

twitter:

- url : https://twitter.com/elvera_dicki

- username : elvera_dicki

- bio : Veritatis exercitationem quia voluptatum laudantium ipsum exercitationem ut. Nihil libero quia voluptatem iste enim ut. Asperiores corrupti ea rem quis.

- followers : 955

- following : 283

instagram:

- url : https://instagram.com/elvera_id

- username : elvera_id

- bio : Nam nam ut cupiditate fuga at. Rerum aut quia quia optio eos incidunt. Aliquam vero non nihil eos.

- followers : 2141

- following : 825

linkedin:

- url : https://linkedin.com/in/elvera8271

- username : elvera8271

- bio : Ut nostrum voluptas quis totam illo.

- followers : 6580

- following : 954